When indexed universal life is set up and used properly, it becomes an incredible foundational asset that builds a strong base for your finances. It grows your money over time, provides many protection elements including the death benefit, AND allows you to access your money to use however you want. See below for a comparison between Indexed Universal Life vs Regular Life Insurance.

This is what sets Indexed Universal Life apart from all the other insurance agents out there. Their education and responses are detailed, they address deeper issues and shed light on additional things to consider. They provide quality life insurance education at its finest.

Indexed Universal Life does the best job, in my opinion, at breaking down financial concepts that bring home the power of utilizing OVERFUNDED WHOLE LIFE as a storehouse of wealth

Jacob at unLocked Financial made understanding Indexed Universal Life (IUL) policies incredibly easy! He walked me through all the options, explained how my money could grow without market losses, and tailored a plan that fit my long-term goals perfectly. Highly recommend him for anyone looking for financial security!

I had no idea how an IUL worked before talking to Jacob, but he broke everything down in a way that made total sense. Now, I have a solid plan for tax-free retirement income and peace of mind knowing my family is protected. If you want someone who truly cares about your financial future, Jacob is the guy to call!

Jacob and unLocked Financial are top-notch! He took the time to explain how an IUL could benefit me, and I never felt pressured—just informed. The process was smooth, and now I have a plan in place that gives me confidence in my future. 10/10 experience!

I was looking for a way to grow my money safely while also having life insurance coverage, and Jacob found the perfect IUL policy for me. His knowledge and professionalism were outstanding, and I feel secure knowing my financial future is in great hands. Highly recommend!

Jacob is the best when it comes to IULs! He answered all my questions, showed me how to maximize my policy, and made sure I was set up for success. I appreciate his honesty and expertise—definitely referring friends and family to unLocked Financial!

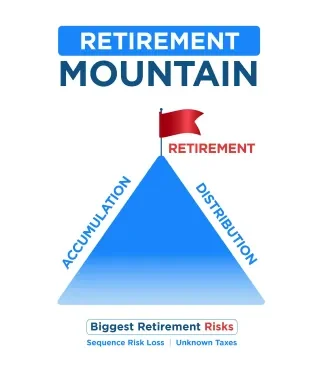

Indexed Universal Life is Overfunded Whole Life Insurance. At its core; life insurance is not an investment but instead is a strong foundational asset. Therefore it shouldn’t be compared to other investments as it has different inherent characteristics than an investment. The And Asset enhances all other investments in one’s portfolio today and in the future.

When you properly structure whole life insurance intended for cash value growth, which we are experts at, you can borrow against your policy roughly 30 days from starting your policy. In some instances it can be even sooner but this is a good number for safe expectations.

If you are older and or have health concerns there are options for you. Please watch this video as it gives you a more detailed response for all of those options. (watch this video)

Some would say if it sounds too good to be true, it is. But the reason why most have never heard of this concept is because it is not taught in formal financial education. It also isn’t offered in standard jobs as a retirement plan. The banks want you to store your capital with them causing life insurance to get a bad wrap as it is misunderstood when it is designed properly for cash value growth. The banks and institutions tell us to store our money with them while simultaneously storing billions of dollars into Life insurance for multi dimensional uses.

Dave Ramsey has provided a ton of value to many families. Dave Ramsey is not for everyone just like Index Universal Life isn’t for everyone. Dave Ramsey is trying to speak to as many people as he possibly can while still being right. Dave Ramsey is not a fan of debt and leverage therefore for most real estate investors, business owners and individuals wanting to build any significant wealth, we believe would be underserved following Dave’s advice.

With that being said we completely understand why Dave says what he says. What he does know about whole life is the typical whole life that is sold in the traditional way so we can’t even say Dave is wrong. Therefore Dave and I are speaking to different audiences. He is an expert in getting people out of debt and we are the experts in setting up and properly using whole life insurance. We are for the audience who wants to build and pass down generational wealth to the people they love the most.